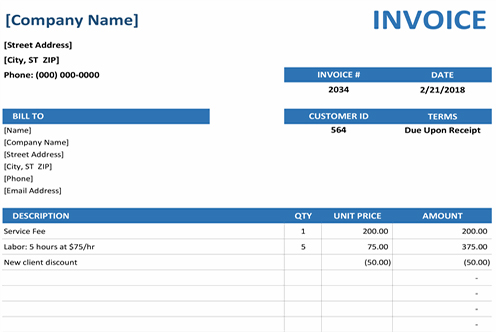

New regulations sanctioning administrative violations of tax and invoices, Decree No. 125/2020/ND-CP dated October 19th 2020 of the Government

Under the new decree, the maximum fine in the tax sector is still 200 millions (for organizations) and 100 millions (for individuals), in the invoices sector is still 100 millions (for organizations) and 50 millions (for individuals).