WHY VBK ?

We specialize in providing services to foreign-owned and FDI company in Vietnam. Our clients from over 22 countries around the world trusted us including multinational and listed companies. We are committed to implementing our mission of Quality First (Quality First) and the spirit of Dedicated Service (Omotenashi) exceed customer expectations. Service quality has complied with international standards and commitment to satisfy all customers.

HOW CAN WE HELP YOUR BUSINESS IN VIETNAM ?

From launching your business in Vietnam to keeping it up and running, VBK provide One-Stop Corporate Services including market entry advisory, investment licensing / company incorporation, as well as company secretarial, accounting, tax, HR & payroll and other advisory services.

WHO ARE OUR CLIENTS ?

Our clients from over 22 countries around the world trust us

United States

United Kingdom

Italy

France

Netherlands

Switzerland

Russia

Spain

Canada

Uruguay

Japan

Korea

Australia

India

Taiwan

Singapore

Hongkong

Thailand

Malaysia

Philippines

VBK's news

VBK Honored to Receive Certificate of Merit from VAA

On July 4, 2025, the 4th Congress of the Vietnam Institute of Chartered Accountants (VICA) (2025-2030) was successfully held in Hanoi.

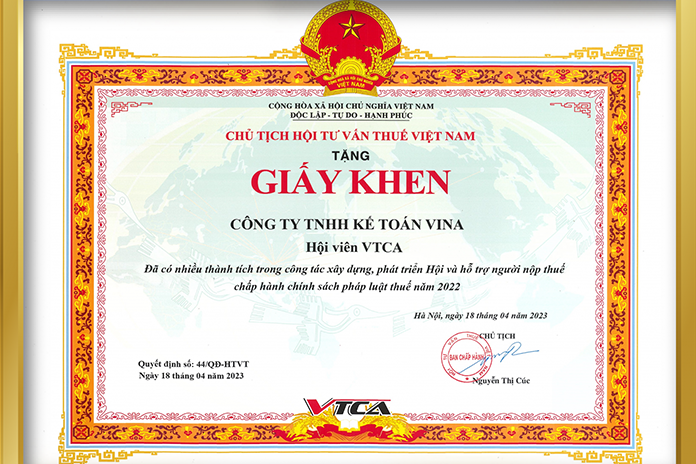

VINA BOOKKEEPING is proud to receive a Certificate of Merit and a Commemorative Medal from VTCA

VINA BOOKKEEPING is proud to receive a Certificate of Merit and a Commemorative Medal from the Vietnam Tax Consultants' Association (VTCA) in recognition of our...

VBK Officially Joins ISCA and Becomes an Accredited Training Organization (ATO)

We are honored to announce that VBK has officially become a member of the Institute of Singapore Chartered Accountants (ISCA).

Looking for an international accounting firm to expand and enroll members in Vietnam.

We specialize in providing services to foreign-owned and FDI company in Vietnam. Our clients from over 22 countries around the world trusted us including multinational and...

ASEAN CPA Certification by ACPACC for VBK’s Key Personnel

We are very pleased to announce that, on May 31, 2023, VBK was honored to be granted ASEAN CPA certification by the ASEAN Chartered Professional...

VINA BOOKKEEPING was honored to receive the Certificate of Merit from VTCA in 2022

On April 21, 2023 in Hanoi, the Vietnam Tax Advisory Association (VTCA) held its 4th Congress and celebrated its 15th anniversary.

Vina Bookkeeping was honored at the 10th anniversary of the establishment of the Vietnam Institute of charters Accountants VICA

On September 9, 2022, the representative of Vina Bookkeeping, Mr. Vo Tan Huu, the General Director of the Company, also a member of the Executive...

VINA BOOKKEEPING was honored to receive the Certificate of Merit from VTCA in 2021

On 15 April 2022 in Hanoi, Vietnam Tax Consultant’s Association (VTCA) held a conference to reward and celebrate the association's establishment.

DOING BUSINESS IN VIETNAM

Singapore is the largest FDI investor in Vietnam in the first half of 2024

Singapore is the largest FDI investor in Vietnam in the first half of 2024 Among the 57 countries and territories...

Foreign Investment Attraction in Vietnam in the First Half of 2024

Foreign Investment Attraction in Vietnam in the First Half of 2024 As of June 20, 2024, the total registered capital...

Foreign Investment Situation in Vietnam for the First Nine Months of 2024

Foreign Investment Situation in Vietnam for the First Nine Months of 2024 As of September 30, 2024, the total registered...

Foreign Investment Situation in the First Quarter of 2024

Foreign Investment Situation in the First Quarter of 2024 (MPI) – As of March 20, 2024, the total registered capital...

Foreign Investment Situation in Vietnam in 2023

Foreign Investment Situation in Vietnam in 2023 As of December 20, 2023, the total registered capital for new, adjusted, and...

Investment Capital from Japan to Vietnam Increases by Over 37% in 2023

Investment Capital from Japan to Vietnam Increases by Over 37% in 2023 In 2023, Japanese investors poured nearly 6.57 billion...

OUR STRATEGIC PARTNERSHIP

We currently cooperate with strategic partners to provide comprehensive one-stop services to our customers in Vietnam.