The National Assembly passed the amended Law on Personal Income Tax dated December 10, 2025

On 10 December 2025, the National Assembly officially adopted the amended Law on Personal Income Tax, comprising 4 Chapters and 30 Articles. Key changes introduced under the revised personal income tax legislation include the following:

(i) Adjustment to the revenue threshold exempt from tax for business households and individuals:

The taxable revenue threshold for business households and individual businesses is increased from VND 200 million/year to VND 500 million/year. Taxpayers are entitled to deduct this amount before applying the tax rate on revenue. Accordingly, the revenue threshold exempt from value-added tax is also raised to VND 500 million/year.

(ii) Personal income tax on employment income (wages and salaries)

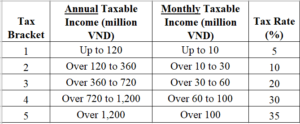

The progressive tax tariff has been adjusted to reduce tax rates for certain brackets to ensure a more reasonable tax burden, avoid sudden rate increases, and further incentivize the workforce. Details:

For further details, please refer to the official website of the National Assembly of Vietnam:

https://quochoi.vn/tintuc/Pages/tin-hoat-dong-cua-quoc-hoi.aspx?ItemID=97463.