Tax Audit Support Services

Protect Your Foreign-Invested Company and Minimize Tax Risks with Vina Bookkeeping’s Expert Support

Navigating a tax audit in Vietnam can be challenging. Vina Bookkeeping’s Tax Audit Support services are designed to protect your Foreign-Invested Company, streamline the audit process, and significantly reduce the risk of penalties.

Current Practice of Tax Audit in Vietnam

In Vietnam, tax audits are a key method used to ensure that businesses comply with tax laws and pay accurate taxes. These audits are conducted randomly or based on specific risk indicators, such such as discrepancies in financial declarations, industry-specific issues, or unusual transaction patterns. The government employs a risk-based approach, focusing on high-risk sectors and companies with complex or irregular financial activities.

During a tax audit, companies must submit extensive documentation, including financial statements, invoices, contracts, and other relevant records. The process involves stages like formal notification, document preparation, onsite inspection, and the issuance of audit findings. Vietnamese tax authorities have implemented advanced digital tools for data analysis, making audits more precise and targeted. Despite this, the scope and complexity of audits often present significant challenges, especially for a Foreign-Investited Company or those unfamiliar with local procedures.

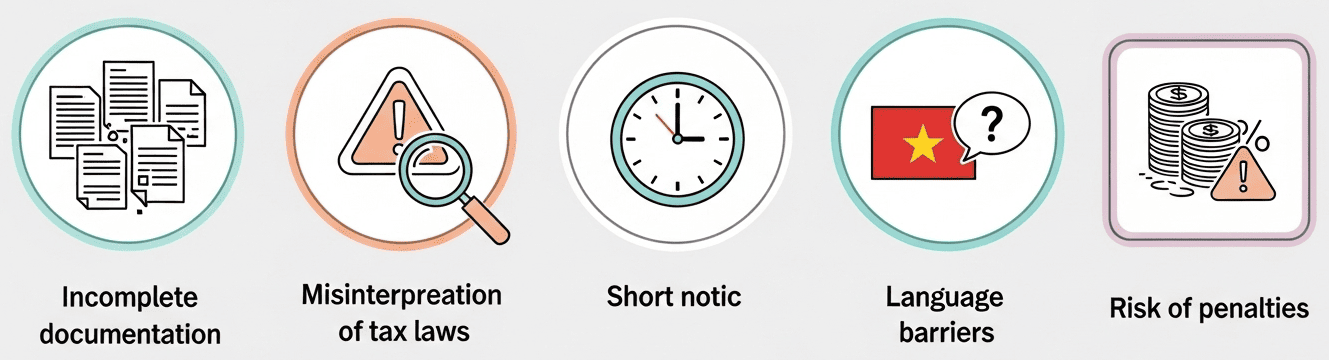

Critical Challenges Faced During a Tax Audit

Businesses in Vietnam frequently encounter several difficulties during tax audits, which necessitate professional Tax Audit Support:

- Incomplete or Inaccurate Documentation: Collecting and maintaining comprehensive, organized records remains a challenge for many, potentially leading to penalties or audit issues.

- Misinterpretation of Tax Laws: The complexity and frequent updates of Vietnamese tax legislation can cause misunderstandings, especially regarding VAT recovery, transfer pricing, or allowable deductions.

- Short Notice and Limited Preparation Time: Unexpected audit notifications allow little time for preparation, increasing stress and the risk of oversight.

- Language Barriers and Lack of Local Expertise: A Foreign-Invested Company may find it difficult to navigate local tax procedures and language nuances, increasing the potential for mistakes.

- Legal and Procedural Complexity: Negotiating and complying with legal requirements without specialized knowledge can result in unfavorable outcomes or penalties.

- Potential Financial Penalties: Failure to comply fully can lead to hefty fines, penalties, and additional tax assessments, impacting your business stability.

What Are Tax Audit Support Services?

Tax Audit Support Services are professional support packages designed to help businesses prepare for, manage, and navigate through tax audits safely and efficiently. These services provide comprehensive review and expert advice on your tax documents, internal controls, and compliance practices. The main goal is to mitigate risks, ensure a smooth audit process, and reduce possible penalties.

Key features of Tax Audit Support include:

- Pre-audit evaluation of your tax records and compliance status.

- Assistance in preparing and organizing necessary documentation.

- Representation and negotiation support during the audit process.

- Identifying areas of potential risk and providing strategies to address them proactively.

- Post-audit review and recommendations for ongoing compliance improvement.

Overall, these services aim to minimize the impact of audits on your business and ensure rigorous adherence to Vietnamese tax regulations.

How Vina Bookkeeping Can Provide Expert Tax Audit Support

Vina Bookkeeping specializes in delivering professional Tax Audit Support meticulously tailored to the Vietnamese market. Our team of seasoned tax consultants understands the complexities of Vietnam’s tax systems and regulations, particularly as they apply to a Foreign-Invested Company.

We start with a thorough review of your financial records, tax filings, and internal controls to identify potential issues before the audit begins. Throughout the process, we provide expert guidance on documentation preparation, legal interpretation, and compliance strategies. Our proactive approach helps companies address vulnerabilities early, reducing the risk of penalties and disputes.

Whether you are a local enterprise or a Foreign-Invested Company, Vina Bookkeeping provides customized support for your tax audit journey—from initial review to final resolution—ensuring your compliance is robust and your business interests are fully protected.

Key Benefits of Vina Bookkeeping’s Tax Audit Support

Partnering with Vina Bookkeeping for Tax Audit Support offers numerous advantages:

- Reduced Risk of Penalties: Expert preparation and guidance help you avoid costly fines and penalties.

- Enhanced Compliance: Ensure your business aligns perfectly with current Vietnamese tax laws and regulations.

- Efficient Audit Process: Speed up the audit process with well-organized, accurate documentation and professional representation.

- Minimized Business Disruption: Maintain your business operations smoothly without the distraction of lengthy or stressful audits.

- Legal and Negotiation Support: Benefit from experienced advisors who can effectively communicate and negotiate with tax authorities on your behalf.

- Long-term Savings: Prevent future issues by establishing strong compliance practices based on our recommendations.

Our Comprehensive Tax Audit Support Process

Our structured Tax Audit Support process is designed to cover every stage of the tax audit:

Initial Planning

We start by thoroughly understanding your business operations, industry specifics, and any prior audit history to identify potential areas of concern and establish clear objectives for the audit preparation.

Documentation and Data Preparation

Our team conducts a meticulous review of your financial records, tax returns, and internal control systems. We ensure all necessary documents are complete, organized, and compliant with Vietnamese tax regulations, assisting in rectifying any discrepancies to make your documentation audit-ready.

Proactive Risk Assessment

Based on the review, we evaluate areas of potential risk or non-compliance that could trigger penalties or disputes. We develop a tailored strategy to address these issues proactively, including recommendations for corrections and improvements to internal controls.

Representation and Support During the Audit

We act as your trusted representative, communicating directly with tax authorities, providing necessary explanations, and submitting requested documentation. We handle negotiations and help resolve any challenges promptly, ensuring your rights are protected throughout the process.

Post-Audit Review and Recommendations

After the audit concludes, we analyze the findings and assist in implementing corrective actions if needed. We provide a detailed report outlining strengths and weaknesses in your current tax compliance and recommend best practices to minimize future risks.

Ongoing Monitoring and Support

We offer ongoing support and periodic reviews to help your business stay compliant as tax regulations continuously evolve. We help you implement continuous improvements to internal controls and documentation processes.

GET AUDIT-READY: CONTACT VINA BOOKKEEPING TODAY

Don’t face the complexity of a Vietnamese tax audit alone. Protect your Foreign-Invested Company with specialized Tax Audit Support from Vina Bookkeeping.

Contact us now to ensure your business is fully prepared, compliant, and confidently represented.