VINA BOOKKEEPING would like to send readers the MONTHLY NEWSLETTER IN SEPTEMBER 2023 (VIETNAMESE AND ENGLISH)

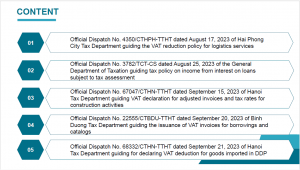

Including regulations and guiding documents from the Government, social insurance, provincial/city Tax Departments on issues related to:

Details of attachments here